Tax Exempt Billing

Request Tax Exempt Status

F5® Distributed Cloud Services enable tax-exempt billing for users and enterprises who are tax exempt. Users can request Tax Exempt Status by submitting requisite documentation such as Tax Exempt Certificate on F5® Distributed Cloud Console under Billing Settings section.

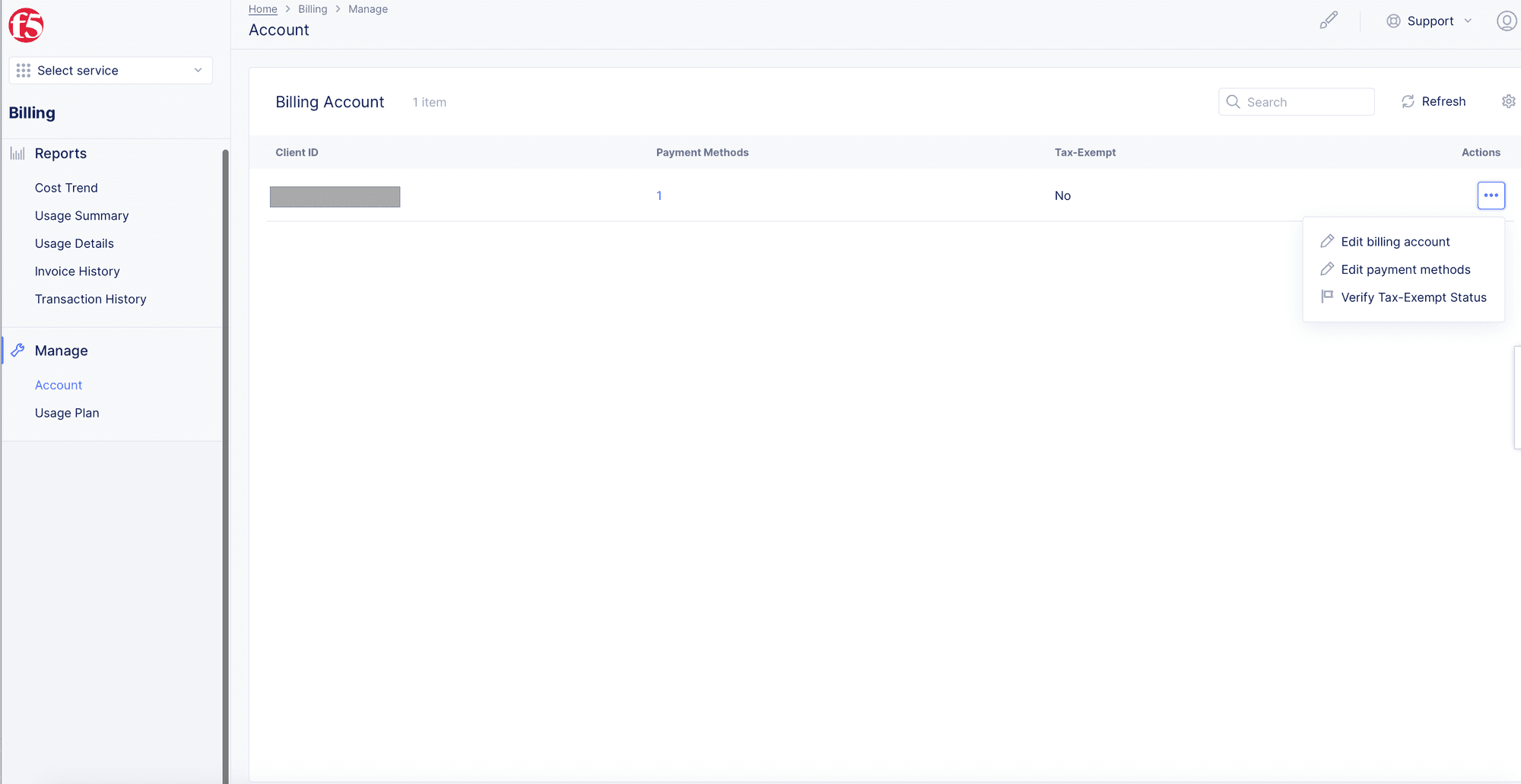

On the the account page under billing section, you can view current tax exempt status. To verify the tax exempt status, perform the following:

-

Log into Console and select the

Billingservice. Go toManage>Account. -

Click

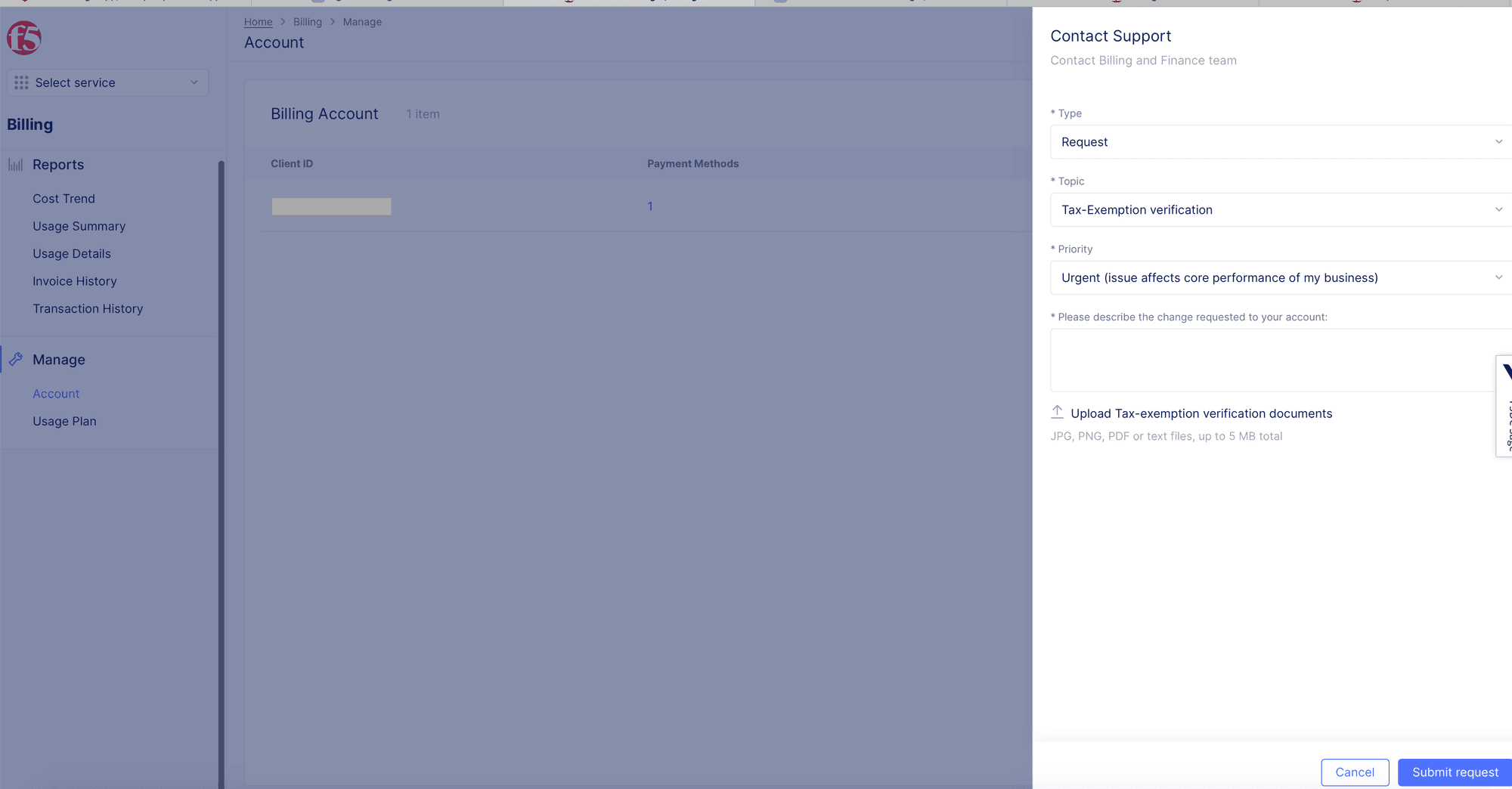

...>Verify Tax exempt statusfor the displayed account. This opens a support ticket.

-

Enter a description in the

Please describe the change requested to your accountfield. -

Click

Upload Tax-exemption verification documentsand upload your tax exempt certificate to the support ticket and clickSend.

F5 Distributed Cloud Services finance team will verify the tax exempt certificate and respond back on the status of your request. You can check the status of your request in the account page under the Tax-Exempt column.

Request for Refund of Tax Paid Prior to Tax-Exempt Status

You can request a refund for tax paid prior to verification of tax exempt status by opening a support ticket on Console.

In the support ticket, you can provide information on the amount of credit requested and copies of the associated invoices.

Note that F5 Distributed Cloud Services will provide a refund of the tax paid in form of a credit in future invoices. If the user cancels their account, F5 Distributed Cloud Services will provide a refund of the tax paid.